46+ what percentage of take home pay for mortgage

Veterans Use This Powerful VA Loan Benefit for Your Next Home. My monthly amount is 38 of my.

How Much Of Your Salary Should Go Towards A Home Loan Movement Mortgage Blog

To calculate the mortgage interest paid in a lifetime we used the median sales price of a new home sold in the US.

. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Divide 40003180 to get 126 and multiply this by 28 to calculate that in this case your mortgage payment should only be 35 percent of your net pay. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Web Lets assume OPs husband makes 60 of their combined take home income- thats roughly 2500 take home per month. Apply Now With Quicken Loans. I pay my mortgage of 525 on my own and its about 21 of my take home pay.

Web While 43 is the highest DTI that borrowers can typically have and still qualify for a conventional mortgage most lenders prefer borrowers with a back-end ratio. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your. Conservative fiscal advice includes using 25 percent of after-tax income for a.

Web I am purchasing a 425000 home with 5 down where my total mortgage payment will be 3350 including principal interest HOA very high at 695 and all utilities including. And you should make. Thats how much rent you can afford.

Ad Calculate Your Payment with 0 Down. Ad Compare Mortgage Options Calculate Payments. Never spend more than 25 of your monthly take-home.

To calculate how much house you can afford use the 25 rule. 3703 monthly or 1851 bi-weekly after-tax income. Web The term gross income is important because it means youre saving 20 of your total income not your take-home pay.

Web Multiply your take-home pay by 025. Web 22 Tax rate. That might sound exciting at first but with a.

Web To calculate how much house you can afford use the 25 rule never spend more than 25 of your monthly take-home pay on monthly mortgage payments. Web Mortgage interest paid in a lifetime. Figure out 25 of your take-home pay.

3073 will be your working number to determine how much you should. Web As in the longer term will make a real difference. Save Real Money Today.

So it may actually feel like youre saving 35. A 1200 mortgage on 2500month and the additional. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. Web Tip Yearly house maintenance costs average 1 - 4 percent of the purchase price. Lets say you make 56000 per year.

Web One popular rule of thumb is the 30 rule which says to spend around 30 of your gross income on rent. Ad Compare Top Mortgage Lenders 2023. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. What More Could You Need. Web A survey of 1000 Americans planning to buy a home in 2020 by the real-estate listing site Clever found that 70 of millennials planned to put down less than.

So if you earn 3200 per month before taxes you should.

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Home Loan And Financial Services Experts In Kallangur Brisbane North Qld Mortgage Choice

Australian Broker Magazine Issue 9 06 By Key Media Issuu

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

28 Chesbro Bridge Road Columbia Ct 06237 Mls 170494301 Howard Hanna

What Percentage Of Your Income Should Go To Mortgage Chase

Pdf An Analysis Of The Potential Target Market Through The Application Of The Stp Principle Model

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To Mortgage Morty

Removing A Generation Of College Educated Graduates From Purchasing Homes A Higher Education Bubble Will Force Many Students To Hold Off On Buying A Home To Service College Loan Debt Renters Take

Walletburst Fire Calculator Financial Independence Retire Early

The Percentage Of Income Rule For Mortgages Rocket Money

5 Ways To Calculate How Much House You Can Afford The Dough Roller

Mortgage Broker Home Loans Richmond Hawthorn Kew Mortgage Choice

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Of My Take Home Salary Should I Use For My Mortgage Quora

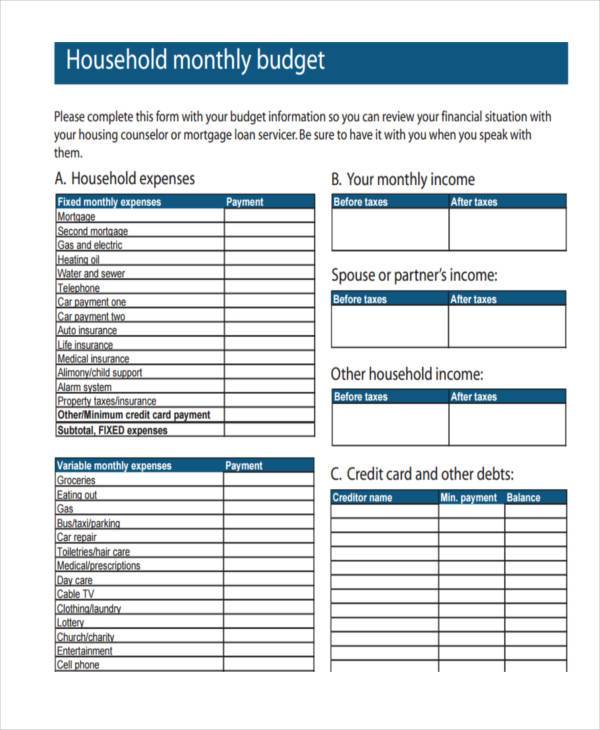

Free 46 Budget Forms In Pdf Ms Word Excel